New Tax Preferential Policy for Overseas Investors in China: Tax Credit from Dividend Reinvestment

The Ministry of Finance, the State Administration of Taxation (SAT) and the Ministry of Commerce have jointly released announcement on the tax credit policy for direct investment by overseas investors using distributed profits (Tax Credit Policy) on June 27, 2025, in order to boost the economy, further encourage overseas investments, and promote continuing operations within China on a long-term basis. The Tax Credit Policy provides the overseas investors tax credit on distributed profits that are re-invested directly in China by satisfying certain conditions.

There are prevailing tax preferential policies introducing deferred withholding tax on distributed profits reinvested directly by overseas investors in China under:

- Cai Shui (2018) No. 102, Circular on Expanding the Applicable Scope of the Policy of Temporarily Not Levying the Withholding Tax on Distributed Profits Used by Overseas Investors for Direct Investment (Circular 102), issued by The Ministry of Finance, the State Administration of Taxation (SAT), the National Development and Reform Committee and the Ministry of Commerce; and

- SAT (2018) No.53, Announcement of the SAT on Issues Concerning Expanding the Applicable Scope of the Policy of Temporarily Not Levying Withholding Tax on Distributed Profits Used by Overseas Investors for Direct Investments (Announcement 53), issued by the SAT.

Circular 102 and Announcement 53 are collectively referred to as “Tax Deferral Policies”.

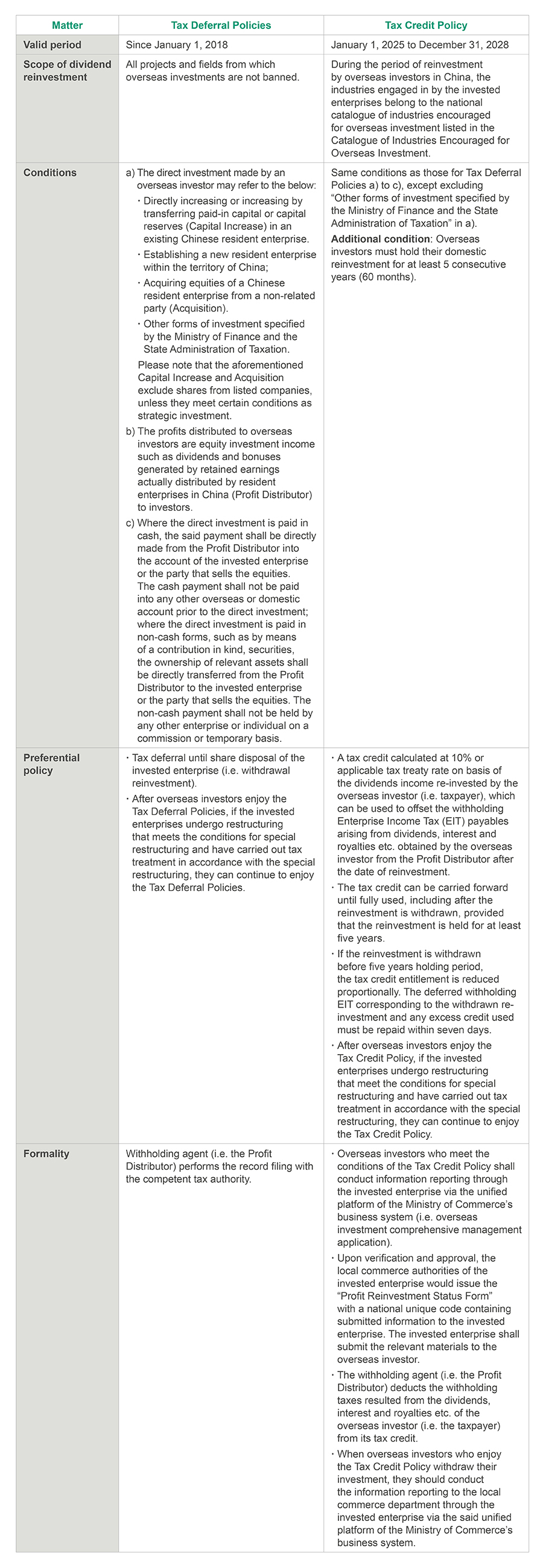

Summary of the similarities and differences of the two sets of policies

The two sets of policies are in place in parallel within a certain time period.

Example

To further illustrate the additional benefits offered by the Tax Credit Policy, we hereby make an example below for reference.

A Chinese resident company, A, distributes dividends of CNY 10 million to its overseas investor B in July 2025.

B uses the dividends of CNY 10 million to reinvest in a Chinese resident company C in August 2025 and withdraws the investment in January 2031.

A distributes dividends of CNY 2 million to B every July from 2026 to 2030.

B, as a non-resident taxpayer in China, the applicable taxation in the given example includes the followings (assuming that treaty benefit is not applicable):

- Tax deferral for dividend reinvestment = CNY 1 million (withholding EIT at 10%)

- Tax credit obtained in 2025 from dividend reinvestment = CNY 1 million

- Withholding EIT at 10% on dividends per year from 2026 to 2030 = CNY 0.2 million

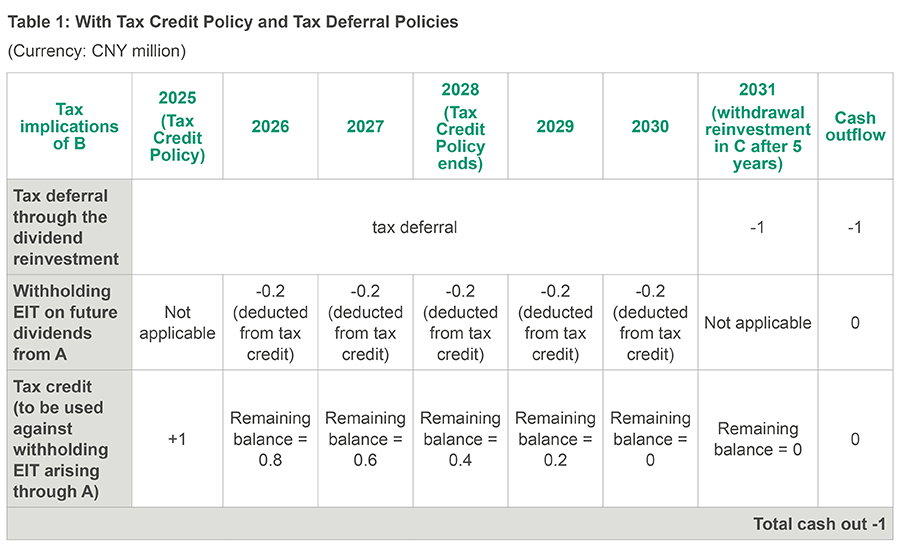

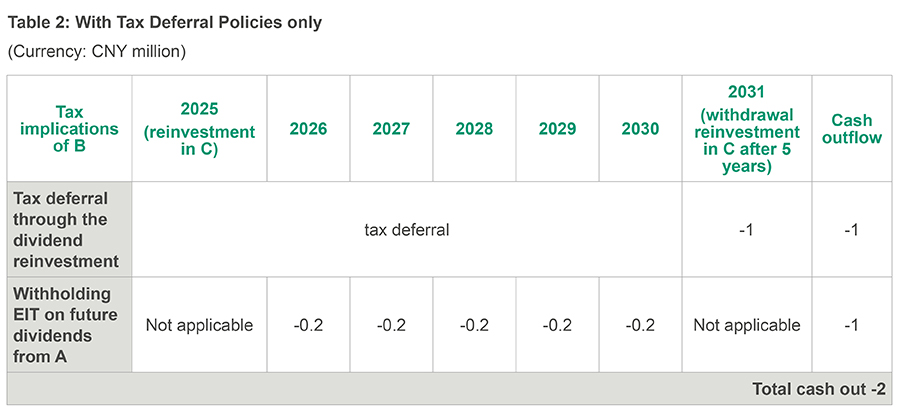

The following tables show tax impact under different scenarios: (1) Table1: applying both Tax Credit Policy and Tax Deferral Policies; and (2) Table 2: applying Tax Deferral Policies only.

In Table 1, it can be observed that the deferred tax of CNY 1 million is paid when the reinvestment is withdrawn in 2031. However, the withholding EIT on future dividends distributed from A to B (i.e. CNY 0.2 million per year from 2026 to 2030) are not paid to the Chinese tax authority by exploiting the Tax Credit Policy. The total cashflow impact in Table 1 is CNY 1 million cash out.

On the other hand, Table 2 has CNY 2 million cash out in total, due to the absence of CNY 1 million tax credit to offset the withholding EIT arising from the dividend distribution for the period from 2026 to 2030.

Conclusion

The Tax Credit Policy offers an additional benefit on top of the Tax Deferral Policies to overseas investors for direct dividend reinvestment in China in terms of tax savings and improving the cash flow efficiency of the overseas investors. Overseas investors that have existing investment in China and intend to carry out a new investment in China from January 1, 2025 to December 31, 2028 may draw special attention to the Tax Deferral Policies and Tax Credit Policy.

Contacts