Mexico: Rules Approved for the Inclusion of Digital Platform Workers in the Social Security Regime

On June 24, 2025, the Official Gazette of the Federation (DOF) published the Agreement ACDO.AS2.HCT.270525/132.P.DIR, issued by the Technical Council of the Mexican Social Security Institute (IMSS), which approves the General Rules for the pilot program to incorporate digital platform workers into the mandatory social security regime.

These rules, issued in compliance with the obligations set forth in Article 291-K of the Federal Labor Law, introduce significant provisions that may present new operational challenges for companies.

The analysis of the text reveals the following obligations regarding social security, among which the following stand out:

1. Register before the IMSS as a digital platform company and obtain an employer registration number:

- At the request of the digital platform company, it may opt for a national employer registration or an employer registration for each administrative operating unit.

- The risk class and premium must be associated with Economic Division 7, categories 711 and 755, "passenger transportation" and "transportation-related services including customs agency management, courier and parcel services, luggage, travel, tourism, and other related transportation activities," respectively, or, where appropriate, with the most similar activity contemplated in the activity catalog included in the Regulations of the Social Security Law.

2. Register with the IMSS all individuals who may provide their services through the digital platform companies:

- Registration must occur upon joining the platform, with at least one daily general minimum wage in Mexico City as the base salary.

- At the end of each calendar month, companies must determine the universe of workers of digital platform companies subject to enrollment under Chapter IX BIS of the Federal Labor Law.

3. Report work-related risks: Digital platform workers who suffer a work-related harm and have not generated net income equivalent to at least one monthly minimum wage in Mexico City will be considered digital platform workers for social security purposes. Furthermore, the employer for whom the work-related accident or illness occurred must cover the insurance under the mandatory regime.

Additionally, on June 26, 2025, the DOF published the agreement approving the general rules issued by the Board of Directors of the National Workers’ Housing Fund Institute (INFONAVIT). These rules aim to regulate INFONAVIT’s participation in the pilot program for digital platforms.

Key obligations include:

- Registering workers with the National Workers’ Housing Fund Institute.

- Submitting the notices required under Article 31 of the Law of the National Worker’s Housing Fund Institute.

- Determining and paying the contribution amounts.

In alignment with the previous publications, on June 27, 2025, the Ministry of Labor and Social Welfare (STPS) published the general provisions establishing the procedures for calculating the net income of digital platform workers, which will serve as the basis for calculating social security contributions.

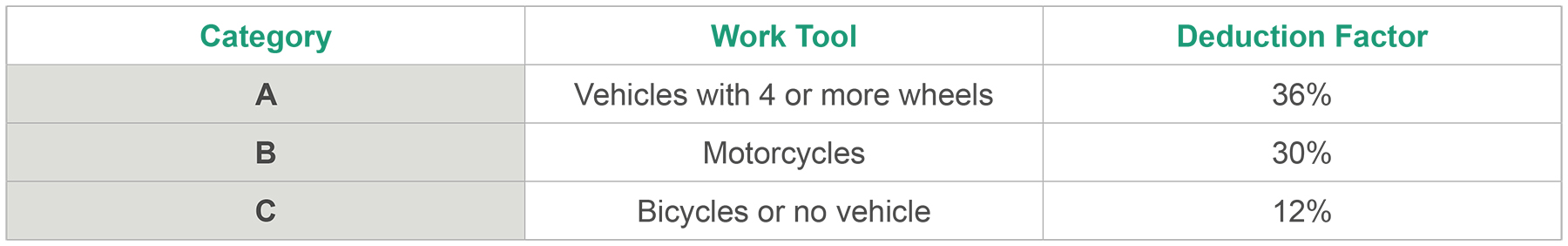

It is established that a deduction factor must be applied to the gross monthly income to account for the use of the platform as a technological work tool.

These factors vary depending on the mode of transportation used:

The application of these factors will be gradual during the first three months to allow for an orderly transition. From July to September 2025, reduced percentages will apply: 60% for four-wheeled vehicles or more (Category A), 50% for motorcycles (Category B), and 15% for bicycles or no transportation (Category C). Starting January 1, 2026, the full officially established percentages will be applied.

Contacts

-

+52 55 5029 8500

-

+52 55 5029 8500